what is liquidity in a life insurance policy

When it comes to life insurance whole life and. What does liquidity refer to in a life insurance policy.

Atlinsurancechic Call For A Free Quote Life Insurance Marketing Life Insurance Quotes Insurance Marketing

Options start at 995 per month.

. Liquidity refers to how effortlessly you can convert an asset into cash. This article looks at liquidity in life insurance policies and how it can benefit policyholders. In life insurance liquidity refers to the cash value of permanent life insurance policies including permanent life insurance universal life insurance and variable life.

Bottom Line Up Front. With respect to life insurance liquidity refers to how easily you can access cash from the policy. However permanent life insurance coverage is accompanied by.

Liquidity in a life insurance policy is a measure of the ease by which you can get cash from your policy while you are alive. In addition to the death benefit they provide permanent life insurance policies have a cash value. The notion of liquidity applies to insurance.

The amount of money that you. The concept applies mostly to permanent life insurance because it. A life insurance policy is an agreement between the insured and the insurance company.

What is a life insurance policy. Find out if you qualify in 10. Speak with a policy specialist today.

Therefore your policy must have a cash value. In short liquidity refers to the ability of a policyholder to access their benefits promptly. Let SelectQuote Find You The Right Coverage.

Ad Get an immediate cash payout for your life insurance policy. Reviews Trusted by 45000000. As Low As 349 Mo.

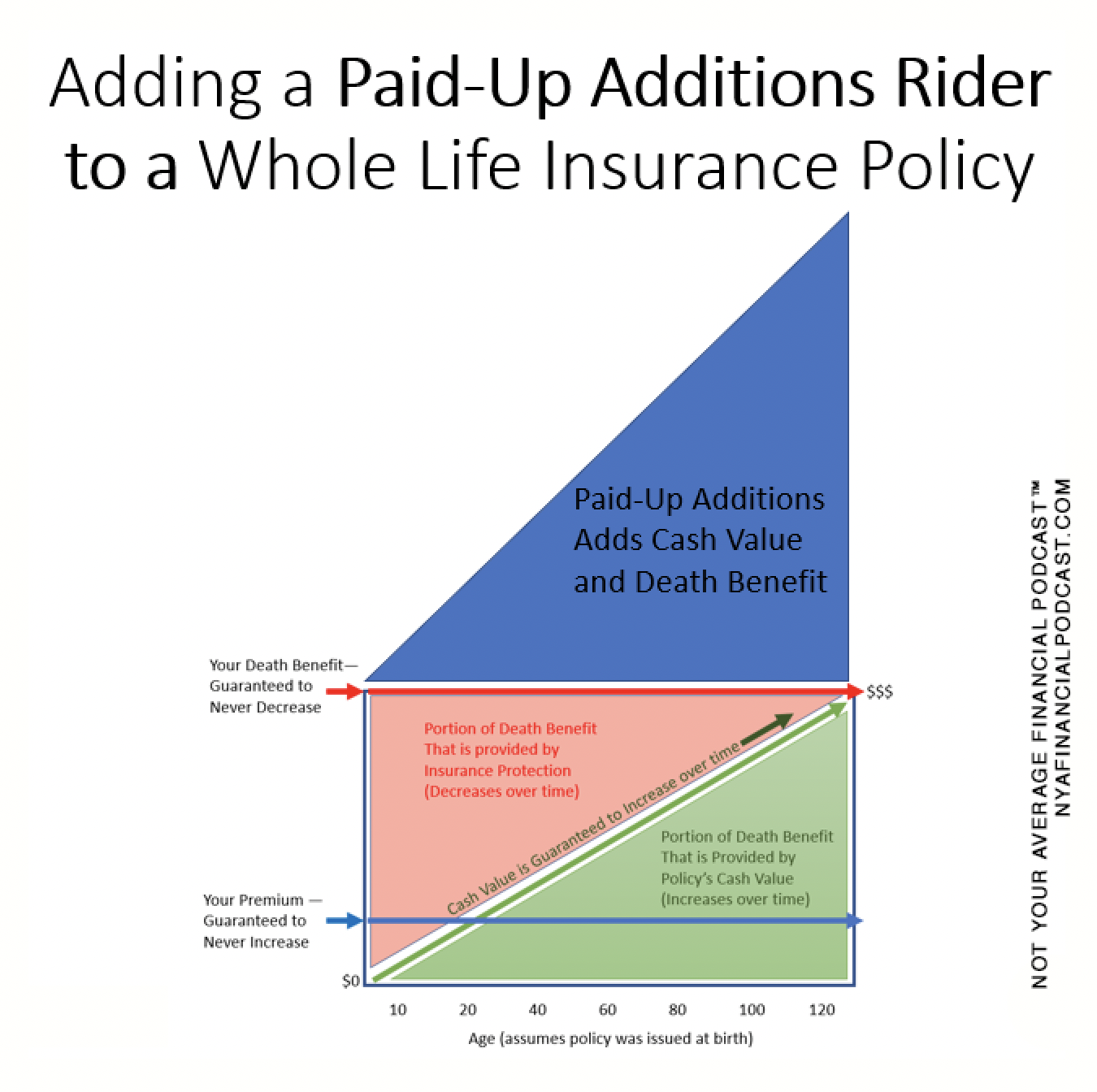

With this type of insurance a portion of your monthly payment is set aside and either put into a cash account or invested. Liquidity refers to how readily available the cash. Now this feature if.

This means that you can access the money in your policy whenever you need it. Ad Compare the Best Life Insurance Providers. One of the key benefits of having a life insurance policy is that it gives you liquidity.

A life insurance policy aims to provide a death benefit to your beneficiaries. Speak with a policy specialist today. The liquidity of an asset refers to its ability to be converted into cash.

Here are a few other questions to help clarify life insurance. The concept applies mostly. Ad Get an instant personalized quote and apply online today.

Ad Get an immediate cash payout for your life insurance policy. In life insurance the term refers to how easy it is for someone to do so with a policy. You cant be turned down due to health.

Liquidity in life insurance refers to your ability as a policyholder to convert the policy into cash especially in an emergency. Ad No Medical Exam-Simple Application. The term liquid can have several meanings including being able to turn into cash quickly.

Benefits of liquidity in a life insurance policy. Find Yours With Us Today. The concept of liquidity in a life insurance policy essentially applies to.

No Medical Exam - Simple Application. Liquidity in life insurance refers to how easy it would be for you to access cash from your policy. In the context of insurance liquidity refers to how easy it is for a policyholder to access cash from their life insurance policy.

So if something happens and you need money quickly you can get it from your life insurance policy. As Low As 349 Mo. Liquidity in life insurance is the ease with which a.

Apply for guaranteed acceptance life insurance. Minimum Required Liquidity In A Life Insurance Policy. You can achieve that liquidity by borrowing.

With respect to life insurance liquidity refers to how easily you can access cash from the policy. Live agents available now. The insurance company agrees to pay a stated.

Ad We Found Jay A 500000 Policy For Less Than 25 Per Month. The liquidity in a life insurance policy refers to how easy the policy can be exchanged for cash without losing its value. Trusted By Over 12 Million Families.

Find out if you qualify in 10. While life insurance policies are structured to provide financial security to your beneficiaries. The liquidity of a life insurance policy refers to the availability of cash value to the policyholder.

Live agents available now. When it comes to life insurance policies liquidity refers to how easily you can get cash from your insurance policy.

Term Life Insurance And Pre Liquidity Planning Wealth Management

Colonial Life And Accident Insurance An Overview For Businesses Quote Com

Four Ways To Access The Value Of A Life Insurance Policy Pacific Life

Understanding Liquidity In A Life Insurance Policy The Reardon Agency

/liquidity-coverage-ratio_final_2-a961e22424864d36b150f62467e2c5ab.jpg)

Liquidity Coverage Ratio Lcr Definition

Adding Life Insurance To Your Financial Portfolio Nationwide

What Does Liquidity Refer To In A Life Insurance Policy

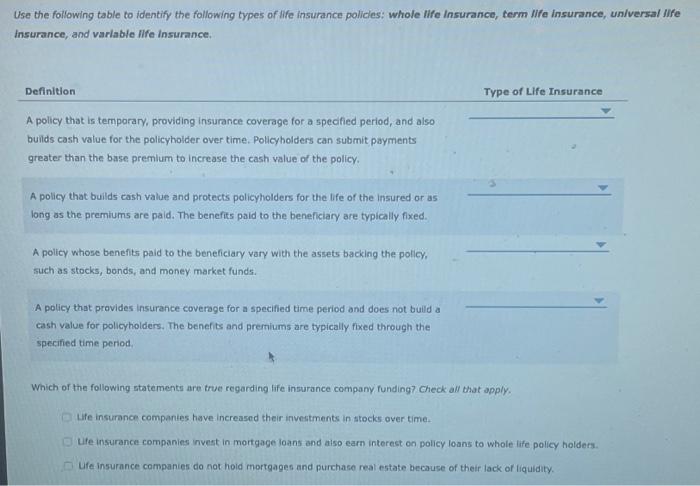

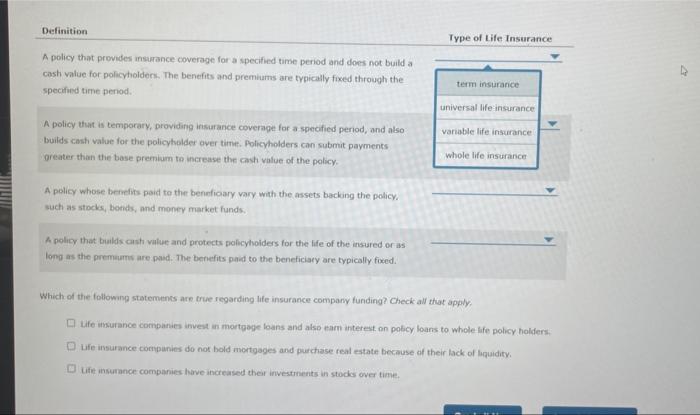

Solved Use The Following Table To Identify The Following Chegg Com

What Is Unit Linked Life Insurance Insurance Laws And Products Switzerland

Find Liquidity For Estate Taxes Without Having To Sell Off Assets

Episode 222 Four Ways To Make Your Cash Value Grow Faster

Solved Definition Type Of Life Insurance A Policy That Chegg Com

Liquidity Risk In Life Insurance

Best Permanent Life Insurance For Infinite Banking

/LiquidityinInvesting-f3d51f463daa42c7a700e7e5916d4efa.jpeg)

What Does Liquidity Refer To In A Life Insurance Policy

Is Whole Life Insurance A Good Investment Forbes Advisor

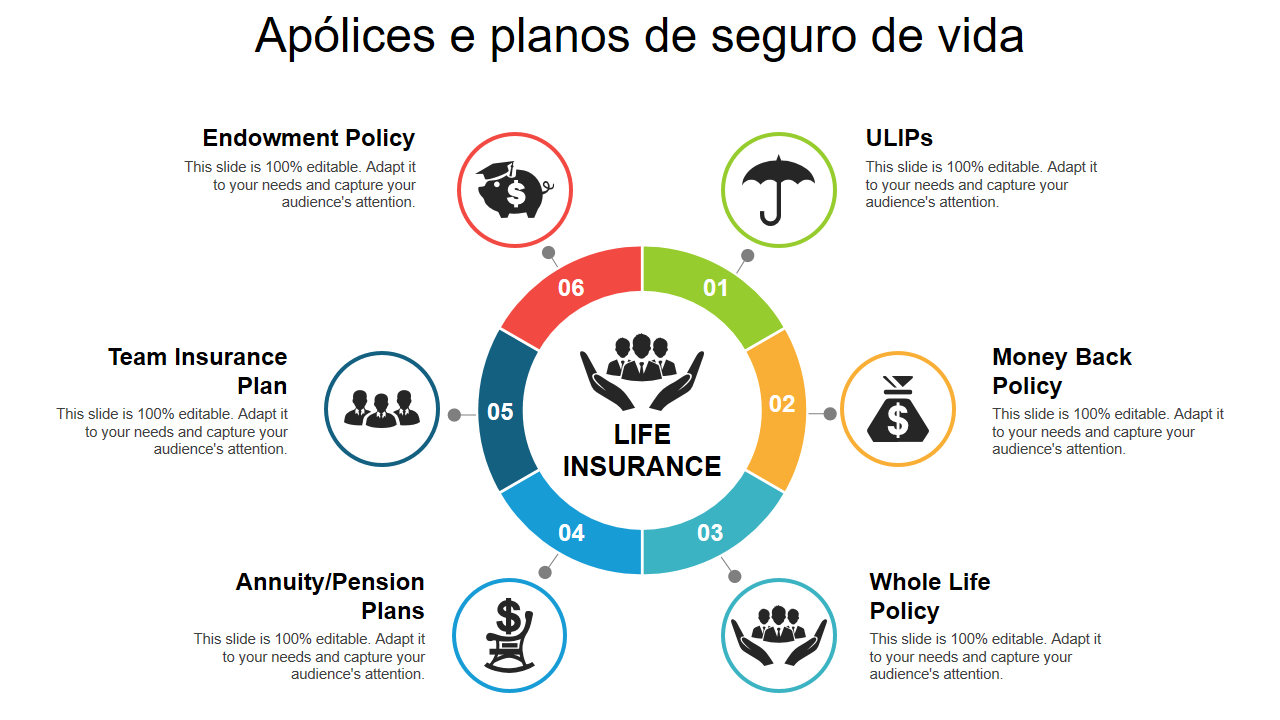

Life Insurance Policies And Plan Template Presentation Sample Of Ppt Presentation Presentation Background Images

Cash Value Life Insurance What You Need To Know The Insurance Pro Blog